NEWS

National Partners in Healthcare Recognized as New Anesthesia Partner Model

As the market for physician services continues to confront pressures stemming from secular changes within health care as a whole, physician organizations are left to evaluate ways to adapt and thrive in a dynamic environment.

Many companies have leveraged merger and acquisition (M&A) strategies to better compete and accelerate growth amidst an industry landscape of changing payment models and shifting competitive dynamics. Exploring independent practice partnership opportunities can provide significant benefits for both shareholders and stakeholders, as these partnerships often provide access to growth capital in addition to nonfinancial resources that allow the business to remain competitive and facilitate growth.

Within the specialty of anesthesia, there has been significant market consolidation that historically was driven by large national organizations, such as Envision Healthcare, based in Nashville, Tenn., and U.S. Anesthesia Partners, based in Ft. Lauderdale, Fla. However, new consolidators have emerged with the goal of offering differentiated partnership options to anesthesiology practices in the market, such as National Partners in Healthcare (NPH), based in Richardson, Texas.

With the influx of new consolidators into the market and continued expansion by existing national players, we at Boston-based Provident Healthcare Partners, an investment bank focusing on health care, expect many independent anesthesia practices will continue to pursue the benefits of a partnership as a means of mitigating risk and capturing favorable economic trends within the sector.

Macroeconomic Drivers

Consolidation within anesthesia has been driven primarily by macroeconomic tailwinds that have attracted an influx of institutional investment.

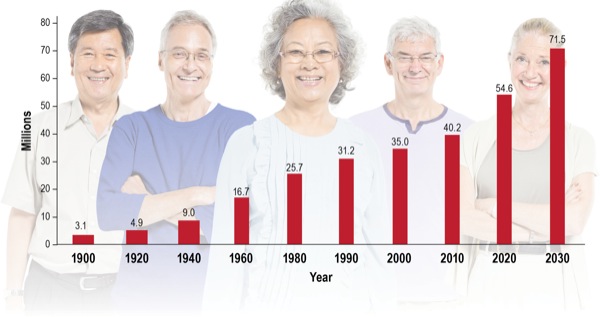

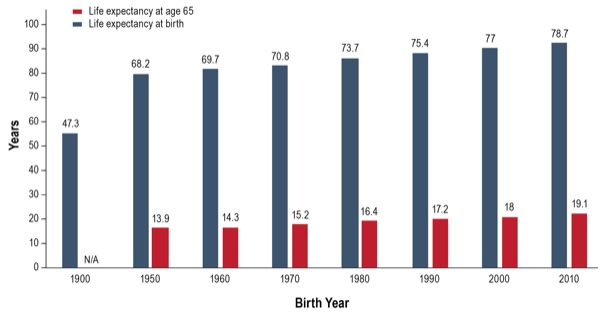

As the baby boomer generation inexorably approaches retirement age, it is anticipated that the total number of citizens over the age of 65 years will reach 80 million by 2035 (Figure 1). As population demographics shift and the average U.S. life expectancy continues to increase, it is expected that over 60% of the elderly population will suffer from more than one chronic condition (Figure 2).

This evolution is expected to have a profound impact on the health care landscape, as providers in both inpatient and outpatient settings prepare for an increase in surgical procedures. While most health care service specialties are poised to grow as a direct result of these changes, the lack of alternatives to anesthesia creates substantial opportunities for practices in the sector. According to Envision Healthcare, a leading provider of multispecialty physician services, anesthesia services produce $19 billion in revenue annually, and that number is set to continue to grow as demand for anesthesiologists increases in tandem with surgical volume.

Hospitals will continue to outsource services to control costs and efficiently handle the rising number of surgical procedures. This allows hospitals to focus on their core services, which provides groups with the opportunity to expand their provider base and inpatient and outpatient medical centers where they practice. These favorable industry opportunities and demographic profile position anesthesia services to grow for the foreseeable future, and that has attracted a considerable amount of investment.

Examining Provider Motivations

As the health care service industry prepares for this shift in patient demographics, independent practices have steadily looked to position themselves to withstand increasing administrative and back-office requirements, costs, and facility coverage. Many organizations have considered transactions to mitigate risks posed by these trends, while also taking advantage of the growth opportunities they provide.

Under the new model of value-based care, providers are required to invest further into their practice infrastructure and employ data transparency tools and evidence-based documentation methods to remain competitive through their contract negotiations. While some practices have opted to reduce shareholder income in an effort to make the required investments to improve back-office infrastructure, others have leveraged partnerships with larger private equity–backed partners who already have these systems in place. For these groups, shareholders can mitigate risk and providers can focus on clinical care and improving surgical outcomes.

Anesthesia practices are facing other challenges that stem from an increase in surgical volume and greater focus on cost-effective care. These trends have seen an increasing number of procedures shifting to ambulatory surgery centers (ASCs) or office-based settings, which provide patients with more entry points into the health care system and are less costly when compared with hospital-based procedures. As a result, anesthesiologists are now expected to sufficiently cover contracts across a wide network of facilities, including independent and hospital-owned ASCs, which can create challenges because providers are spread across multiple sites, with less stable contracts.

For practices choosing to explore strategic partnerships as a means of mitigating risk, the resources of a partnership can provide the capital required to hire additional anesthesiologists and certified registered nurse anesthetists (CRNAs), or provide access to a broader pool of providers—required to sufficiently cover a broader network of facilities.

While independent organizations have the option to reduce shareholder distributions or take on personally guaranteed debt to fund these initiatives, strategic partnerships can propose a solution by assuming market-rate compensation for each provider and providing the capital required to remain competitive in a challenging environment. This has led many independent organizations to explore the various partnership opportunities available to them with both private equity firms and private equity–backed portfolio companies as they navigate the shifting landscape within today’s health care environment.

Exploring Partnership Opportunities

Over the last several years, many independent practices have opted to align with a private equity firm or strategic partner for myriad reasons, including reducing administrative burden, fueling growth, or using a transaction as a succession plan for an aging shareholder base.

For practice owners looking for opportunities to scale their business beyond its current trajectory, pursuing a private equity partnership can help provide the practice with the capital and resources required to grow, whether that’s through a strategy relying heavily on acquisitions or a model focusing on de novo growth.

For smaller independent groups, partnering with a private equity–backed organization provides the group with increased clout in contract negotiations, access to a broader network of providers, and the resources and infrastructure of a larger organization.

Private equity refers to a group of investors and funds that seeks to make direct equity investments into privately owned businesses. Private equity professionals invest the funds into companies that are aligned with their investment, seeking to exit their investment within three to seven years for a substantial return on invested capital.

Upon investment or “recapitalization,” a private equity firm will acquire an ownership stake in a private business, providing the shareholders with significant up-front liquidity, taxed at a capital gains rate, with the opportunity to roll equity into the newly recapitalized business. Post-transaction, private equity firms provide access to capital and the expertise required to improve the business, both operationally and financially, positioning the company for future growth.

The strategy varies from model to model; however, in most cases, private equity firms will provide their portfolio companies with the capital required to expand their facility coverage within a geographic area organically through de novo initiatives and inorganically by completing add-on acquisitions in both new and existing markets.

In the historical model of M&A in anesthesia, consolidators sought to buy out practices entirely, accumulating all the profits generated by providers. Shareholders, who were previously accustomed to distributions based on productivity and practice profitability, were signed to flat salaries, creating an environment with potential for misaligned growth incentives. As consolidation trends have evolved, general partners realized a change was necessary to align incentives.

As M&A strategies for physician services have evolved, anesthesiologists who choose to partner with a private equity–backed platform have an opportunity to retain ownership while also receiving a large up-front payment that is taxed at capital gains rates. This business model allows each provider to benefit from the growth of the parent organization as it expands through add-on acquisitions and de novo initiatives. After a three- to seven-year holding period, many private equity groups will look to exit their investment, targeting a substantial return of three to five times their initial investment. Upon their sale to another platform or private equity group, the shareholders of the practice will have the opportunity to roll equity once again with the next partnership or receive cash proceeds. This model provides shareholders with the opportunity for multiple liquidity events based on subsequent transactions.

Market Activity

The growth strategies of the industry’s largest consolidators have begun to slightly shift in lockstep with the broader health care landscape. As several private equity–backed platforms continue to scale through acquisition-based strategies, independent practices now have several options to consider when exploring the benefits of a private equity partnership. Despite the relative maturity of the market, transaction activity remained steady through the first half of 2019, driven predominantly by add-on acquisitions (Figure 3).

Figure 3. Strategic transaction activity.

Similar to other health care service verticals, the anesthesia specialty has seen waves of consolidation activity driven by both private equity–backed platforms and new market entrants. Industry giants such as Mednax, headquartered in Sunrise, Fla., and Envision, which were once responsible for most of the consolidation activity in the space, have become less active in recent years as they continue to focus on building out complementary service offerings such as radiology, pediatrics and women’s health. On the other hand, strategic consolidators such as North American Partners in Anesthesia, based in Melville, N.Y., and PhyMed, based in Nashville, continue to search for add-on acquisition opportunities to bolster platform growth.

As the aforementioned platforms continue to grow, new market entrants also have kicked off a new wave of consolidation. NPH, which was founded in 2018 as a joint venture between Archimedes Health Investors and BlueMountain Capital Management, has been deploying capital quickly, completing three practice acquisitions in the southwestern United States in less than six months.

NPH has invested heavily into technology and data-gathering tools to provide their anesthesiologists and CRNAs with the resources required to remain competitive with national consolidators. While strategic consolidators continue to focus on platform growth in anesthesia services, robust investor interest still provides opportunities for independent practices to be platform investments of their own.

Although the anesthesia market has been consolidating for almost 20 years, it continues to see robust investment and transaction activity. This has been primarily driven by a steady influx of private equity capital, creating an abundance of partnership opportunities for physician owners in the sector.

As shareholders continue to explore partnership options, it is important to ensure that they educate themselves regarding the potential benefits and risks of pursuing a transaction. Through up-front diligence and thorough education, groups can arrive at well-informed decisions regarding different partnership strategies and alternatives.

New York City via Anesthesiology News